Ach Or Wire

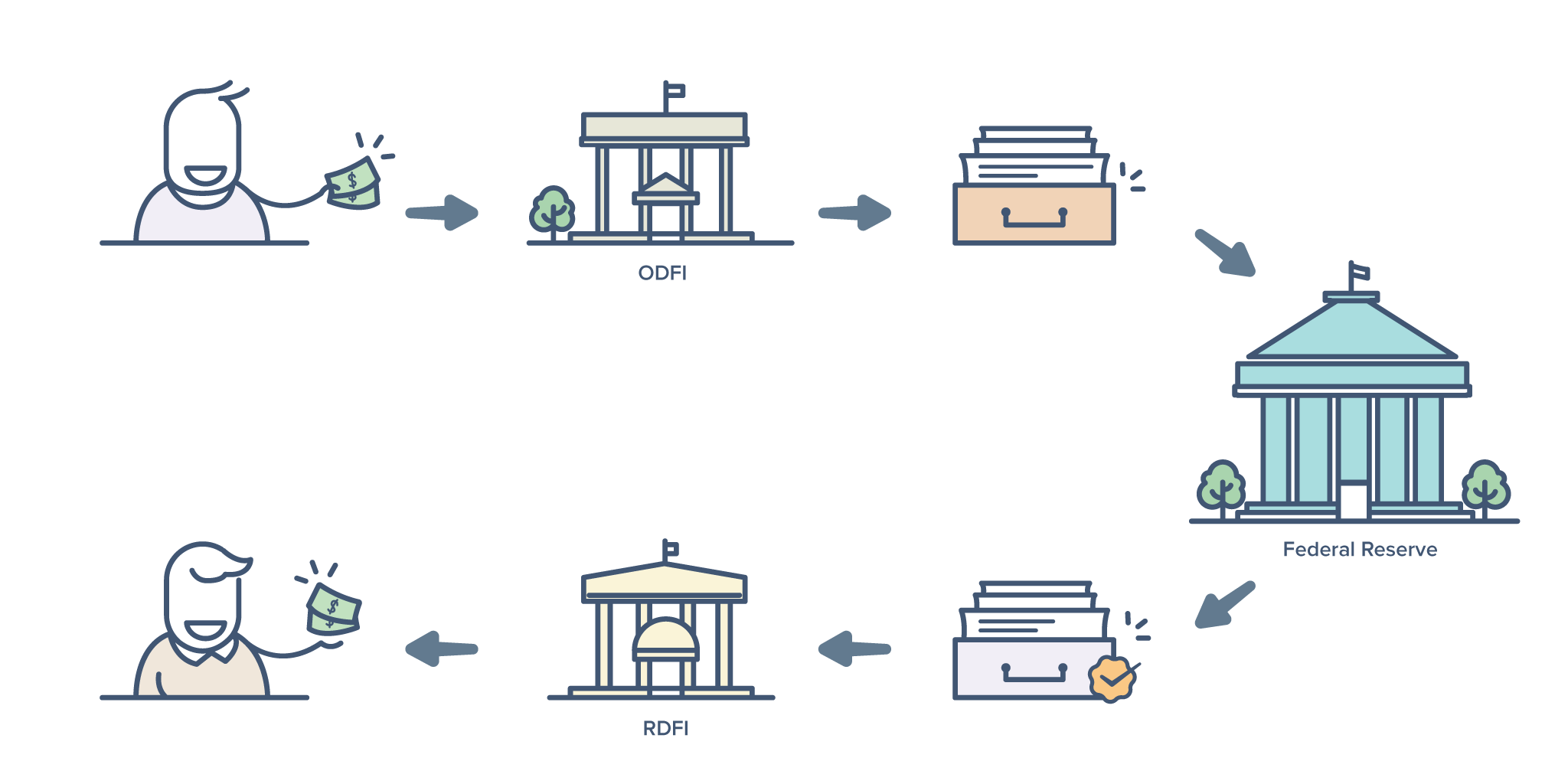

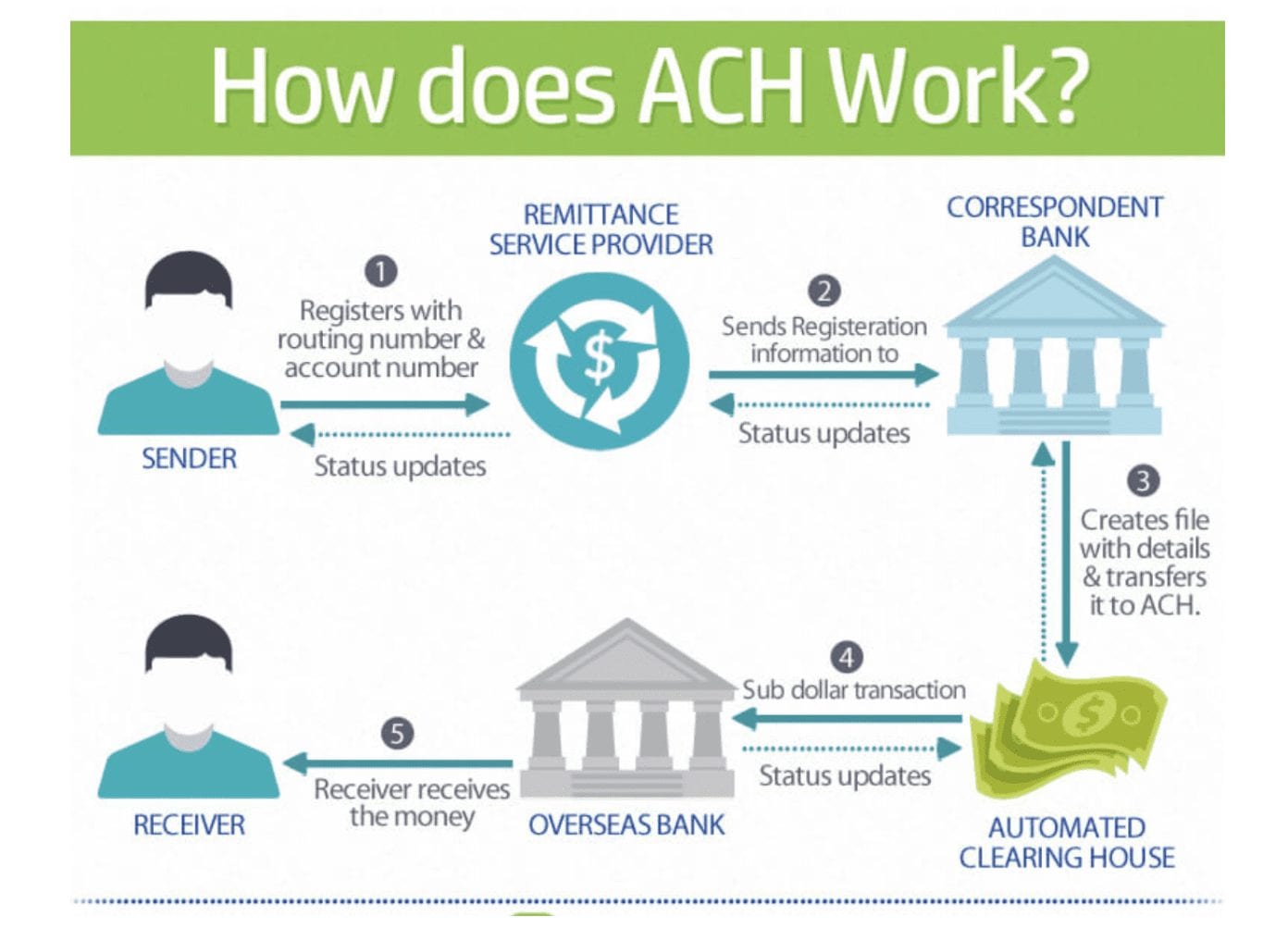

Essentially these financial institutions group ACH transactions together and transfer these groups of transactions three times each day. However the two are quite different and understanding the differences between them is beneficial for anyone who is interested in using electronic methods of payment for moving money to and from bank accounts.

Ach Transfer Vs Wire Transfer Comparison Guide Reliabills

Ach Transfer Vs Wire Transfer Comparison Guide Reliabills

Exactly what fees you pay will differ depending on which bank you make the wire.

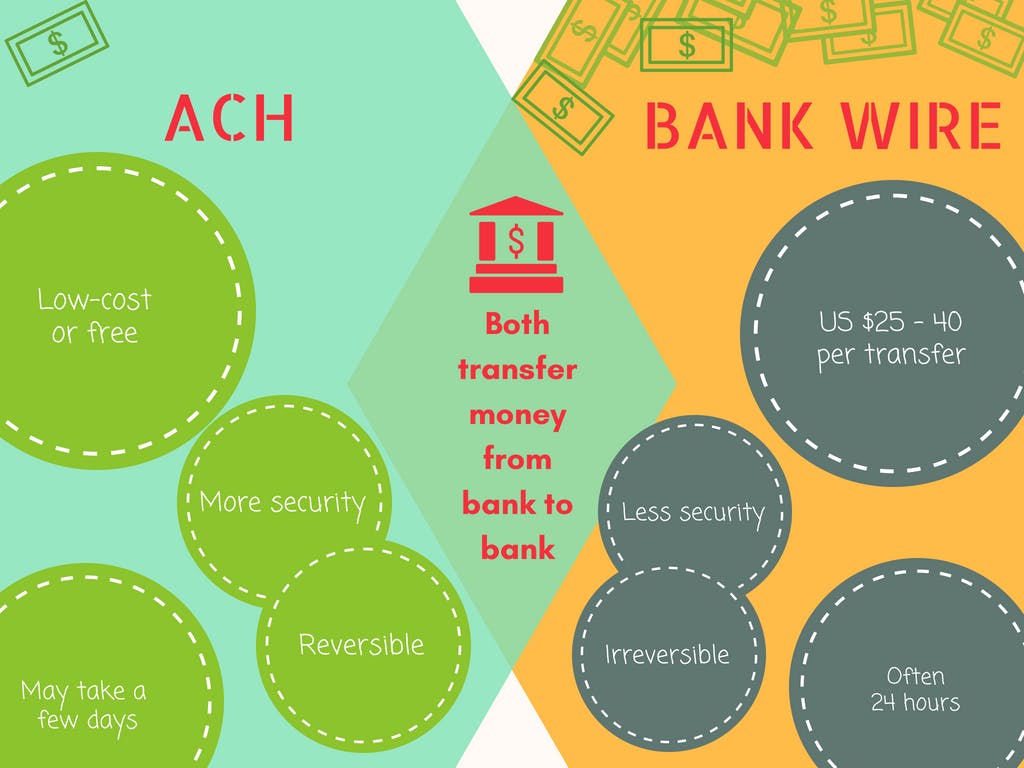

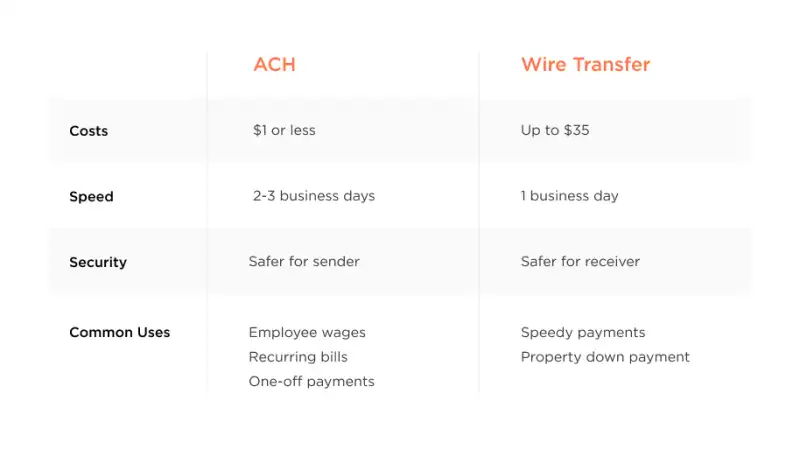

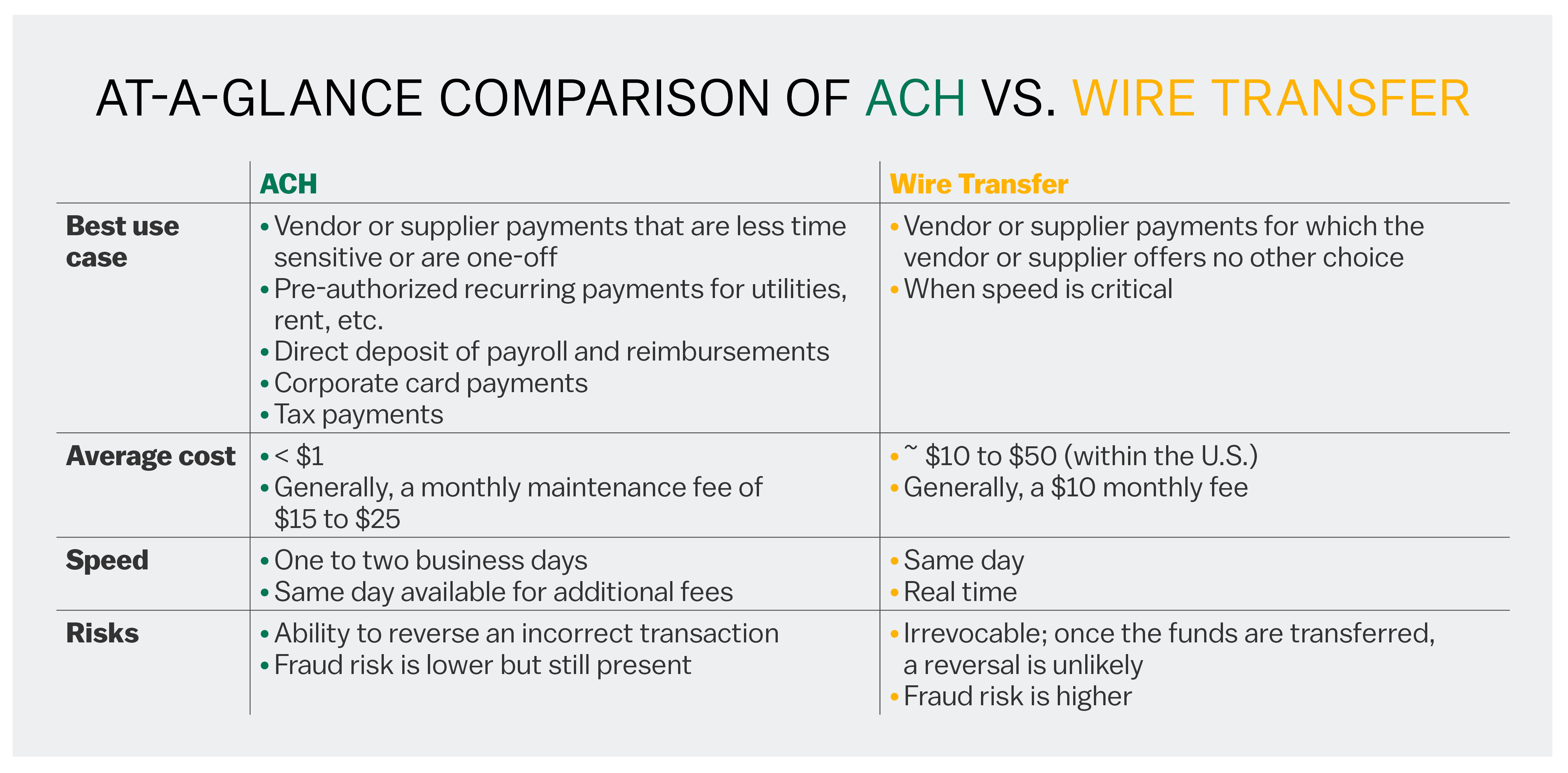

Ach or wire. The biggest benefit of wire transfers is speed or availability of funds. ACH payments are generally more secure compared to wire transfers. Wire transfers can only be payments.

ACH transfers are monitored by the Federal Reserve and run through an automated clearinghouse between parties which means they are considered to be safe and provide means for reversal if something is incorrect. Wire transfers cost money for both the sender and the receiver whereas ACH payments are free or cost very little per transaction. Otherwise why pay the fee and.

Unlike the batch-processing nature of ACH transfers wire transfers are designed for individual transactions. Advantages Disadvantages of ACH payments versus Wires. Wire transfers will cost you money and the fees can really add up.

Wire transfers are best when speed and certainty are critical. The ACH network is a network of banks and other financial institutions that uses batch processing to transfer funds from bank to bank. Both are wire transfers and ACH transfers are safe.

Wire transfer speeds are faster than ACH payments. ACH and wire transfers are both certain transfers although theres a bit more certainty and finality in a wire transfer since most cant be reversed. Because of clearinghouse rules ACH payments are often more secure than wire transfers.

If you want to request payment you will have to use another form of money transfer. There are some noticeable differences between ACH Transfers and wire transfers. Wire transfers can be sent internationally whereas ACH is.

Wire transfer is mostly used for a large amount of money and its expensive as compared to ACH which is. They may seem similar almost identical. To complete a wire transfer you will need the same information as an ACH transfer request.

You can send money to a person located across the country or halfway around the. Because of the differences described above wire transfers and ACH transfers serve different needs. ACH payments are less expensive than wire transfers.

Even though both allow the transfer of funds both domestic and international electronically there is quite a lot of differences between them eg. ACH gives more protection to senders and wire transfers touch fewer hands. Wire transfers use a different network to send money between banks electronically.

Wire transfers are initiated and processed by banks while ACH payments are processed automatically through a clearinghouse. Wire transfers also involve higher costs. While Ach transfers do not involve any human intervention wire transfers are handled by employees at the bank.

Wire transfers are electronic transfers that are processed by banks while ACH transfers are also electronic transfers but are processed by the Automated Clearing House Network. A significant difference when comparing ACH vs wire transfer is the cost. ACH transfers are safe.

The benefit of wire transfers compared to ACH transfer is that. ACH is done through batch processing whereas wire transfers are done real time. ACH transfers and wire transfers are methods of moving funds from one bank account to another.

The only difference is that the transfer goes from the originating financial institution to the receiving financial institution with no intermediary. This process is overseen by National Automated Clearing House Network NACHA. They are transfers from one bank account to another but the sender can reverse them.

For wire transfers only the sender can initiate. ACH is a cheaper transaction than wire transfers. Wire transfers are very similar to ACH transfers.

Thats all about the difference between Wire transfer and ACH automated clearing house. Main Differences Between ACH and Wire Payment The major difference between ACH and Wire payment is that in ACH the transfers can take two to three days to clear the payment but in Wire payment it is quick it takes only a couple of hours to clear the payment. ACH transactions are almost always completely free for individuals to make and receive.

Ach Vs Wire Transfer What Is The Difference

Ach Vs Wire Transfer What Is The Difference

Ach Vs Wire Transfers Which To Use To Pay Employees

Ach Vs Wire Transfers Which To Use To Pay Employees

Ach Vs Wire What Small Business Owners Need To Know

Ach Vs Wire What Small Business Owners Need To Know

Ach Vs Wire Transfers Everything You Need To Know

Ach Vs Wire Transfers Everything You Need To Know

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png) Key Differences Between Ach And Wire Transfers

Key Differences Between Ach And Wire Transfers

Ach Vs Wire Transfers What S The Difference Quickbooks

Ach Vs Wire Transfers What S The Difference Quickbooks

Learning About Ach And Wire Transfers Brex

Learning About Ach And Wire Transfers Brex

Ach Vs Wire Transfers For Payment Collection Merchant Cost Consulting

Ach Vs Wire Transfers For Payment Collection Merchant Cost Consulting

Ach Vs Wire What Small Business Owners Need To Know

Ach Vs Wire What Small Business Owners Need To Know

Ach Vs Wire Transfers What S The Difference Quickbooks

Ach Vs Wire Transfers What S The Difference Quickbooks

Comments

Post a Comment