Tennessee State Income Tax

As of 2020 the state had a 1 tax on income earned from interest and dividends though it has fully repealed it beginning on Jan. No cities in Tennessee levy local income taxes.

Tennessee Income Tax Calculator Smartasset

Tennessee Income Tax Calculator Smartasset

The Hall Income Tax instituted a six percent tax on interest and dividend income for individuals living in Tennessee.

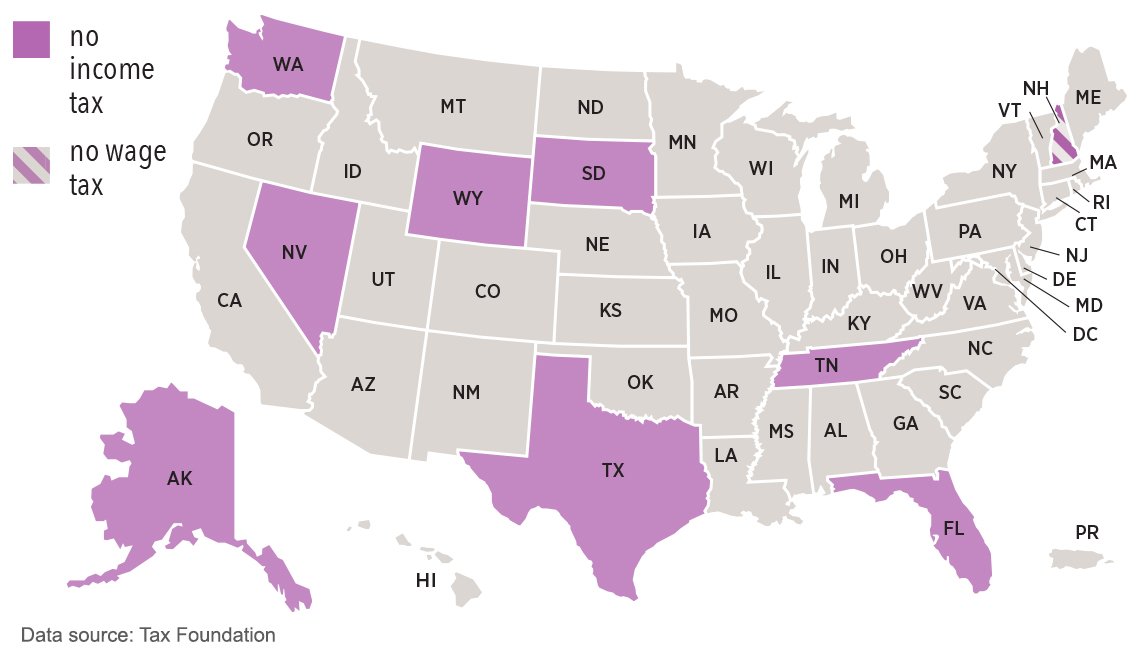

Tennessee state income tax. The Tennessee income tax has one tax bracket with a maximum marginal income tax of 100 as of 2021. 2 of taxable income for tax years beginning January 1 2019. Tennessee is one of nine states that does not collect a general income tax.

Tennessee is one of nine states that does not collect a general income tax. The state does levy the Hall Income Tax though named after the Tennessee state senator who sponsored the legislation in 1929. The sales tax rate on food is 4.

Tennessees Hall Tax was a 6 tax on dividends and interest income until state legislators passed a bill in 2016 that began a six year phaseout of the Volunteer States only income tax taking it. However the state does collect taxes on interest and dividends earned on investments a form of income tax known as the Hall tax Enacted in 1929 the Hall tax was previously a 6 tax levied on interest earned on bonds and notes and dividends from stock. Tennessee has set income tax exemption amounts for single joint filers which allow you to earn a certain amount of taxable income without paying taxes.

In Tennessee there is no income tax on wages. The Center Square The top marginal income tax rate for residents of Tennessee stands at 1 percent according to a new study of state individual income tax rates by the Tax Foundation. However the state does collect taxes on interest and dividends earned on investments a form of income tax known as the Hall tax Enacted in 1929 the Hall tax was previously a 6 tax levied on interest earned on bonds and notes and dividends from stock.

Detailed Tennessee state income tax rates and brackets are available on this page. State single article - 275 on any single item sold in excess of 1600 but not more than 3200. Tennessee has no state income tax on salaries wages bonuses or any other type of work income.

Tennessee residents are only taxed on dividend and investment income if dividend and investment income exceeds preset limitsIf you did not have dividend or investment income then this is a situation where you would not need to file a Tennessee state tax return. A few products and services such as aviation fuel or telecommunication services have different tax rates. Are Federal Taxes Deductible.

Eliminating the Hall Tax is a great way to start off the New Year for Tennesseans. The state levies a single-rate income tax on individuals. Automobile Rental Surcharge Tax.

You only have to pay state income tax if the amount of income you earned from taxable investment and interest sources is greater than the applicable tax exemption for your filing status. State tax - The general sales tax rate for most tangible personal property and taxable services is 7. Because the Tennessee income tax applies only to certain types.

4 of taxable income for tax years beginning January 1 2017. It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends. The Hall income tax is imposed only on individuals and other entities receiving interest from bonds and notes and dividends from stock.

Regardless of whether the income is taxable for federal income tax purposes and without deduction for loss. Franchise. If the total annual income derived from any and all sources exceed the above limits file the Tennessee income tax return only if taxable interest and dividend income exceed 1250 2500 if married filing jointly.

Information about those taxes is available as well as forms needed. The Hall income tax is being eliminated and the applicable tax rate for each year of the phase out is as follows. Therefore the Tennessee income tax rate is 0.

There is no income tax on wages in this state. AFP-TN State Director Tori Venable issued the following statement. It was enacted in 1929 and was originally called the Hall income tax for the senator who sponsored the legislation.

Tennessee Income Taxes. Whats the Tennessee Income Tax Rate. Tennessee State Single Filer Personal Income Tax Rates and Thresholds in 2021.

3 of taxable income for tax years beginning January 1 2018.

/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png) The Best And Worst States For Sales Taxes

The Best And Worst States For Sales Taxes

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

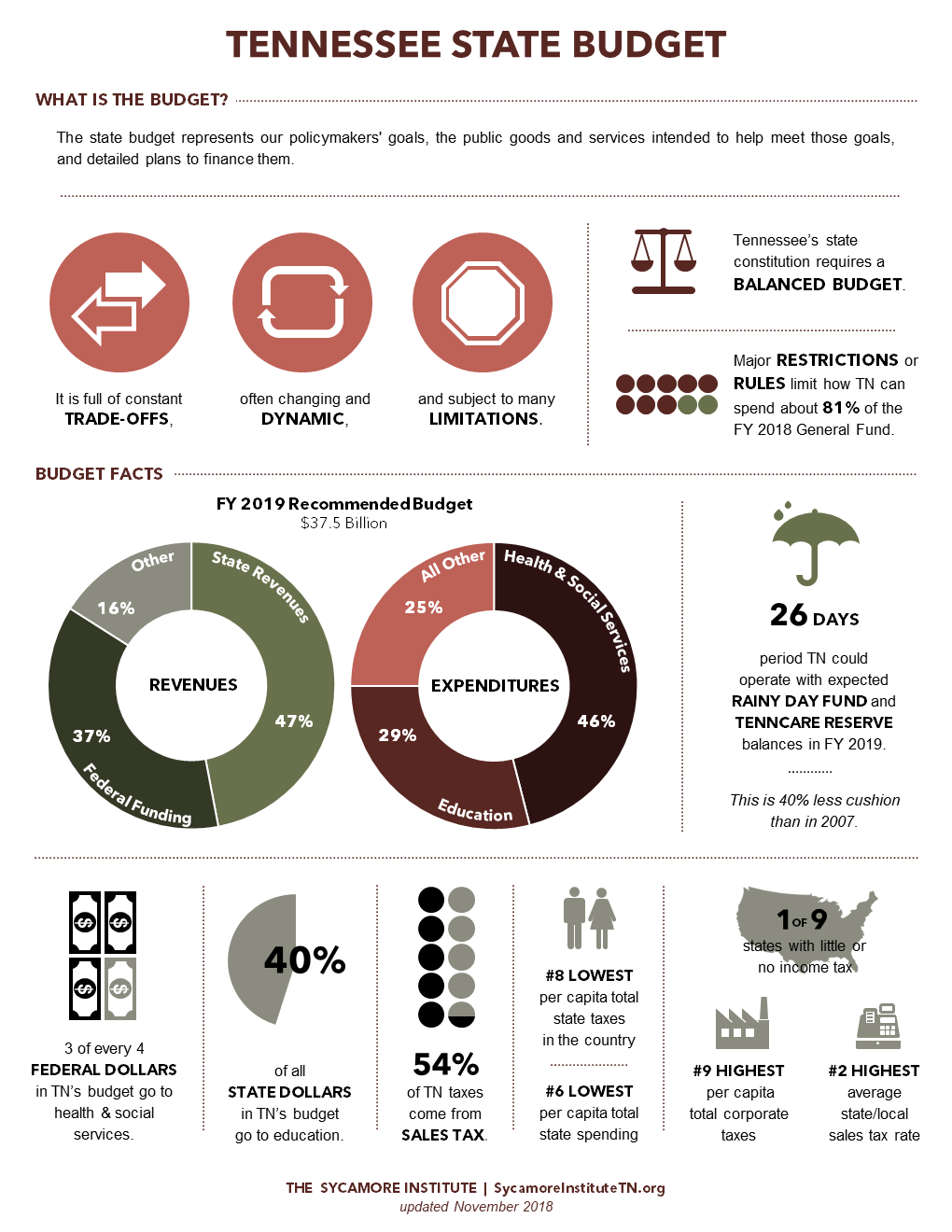

Tennessee Budget Primer The Sycamore Institute

Tennessee Budget Primer The Sycamore Institute

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Tennessee Now Has Highest Sales Tax Nationwide

Tennessee Now Has Highest Sales Tax Nationwide

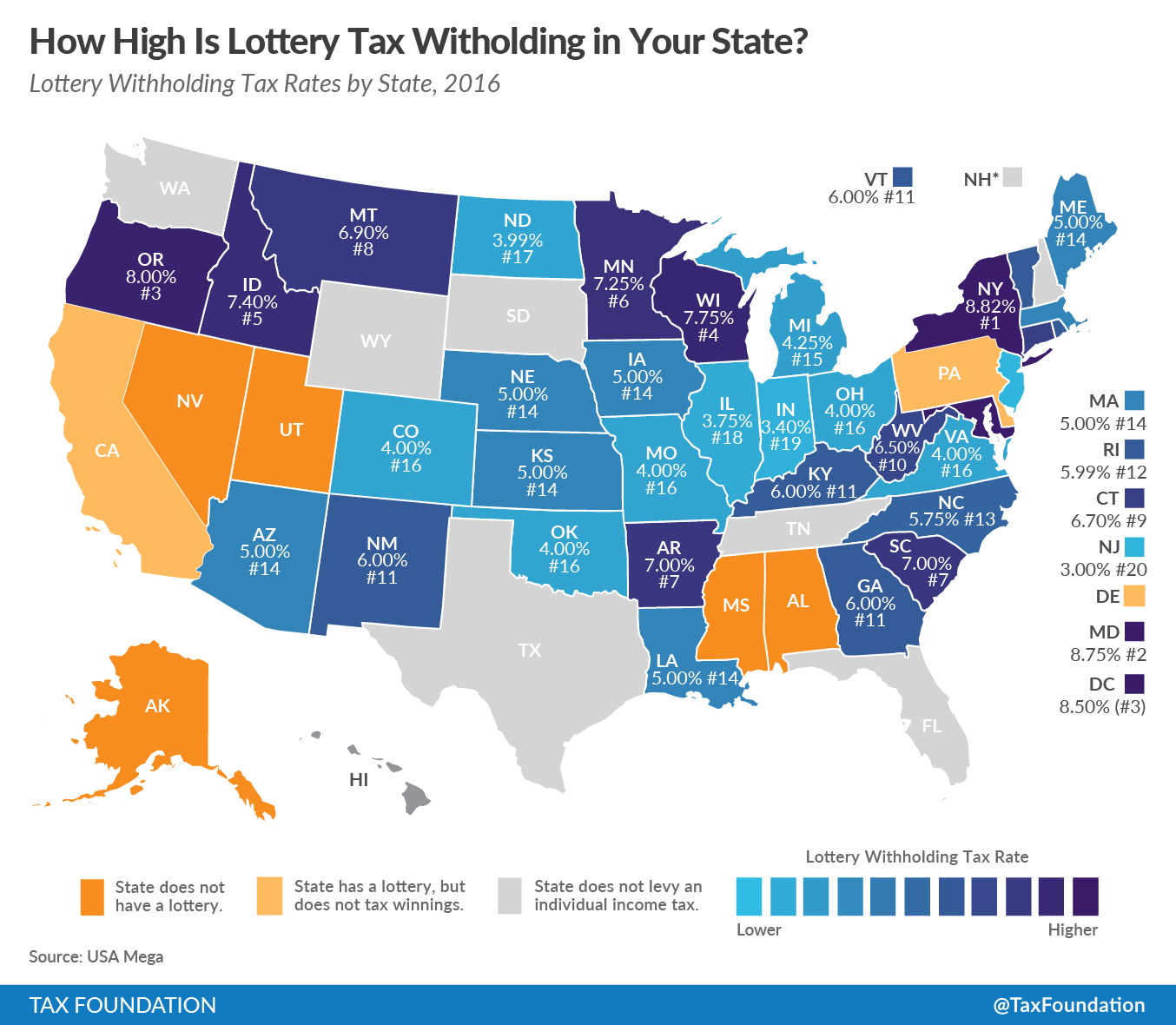

Income Tax Free Tennessee Means That Someone Won The Lottery Twice Tax Foundation

Income Tax Free Tennessee Means That Someone Won The Lottery Twice Tax Foundation

Tennessee Considers Eliminating Hall Tax American Legislative Exchange Council

Tennessee Considers Eliminating Hall Tax American Legislative Exchange Council

Tennessee Income Tax Calculator Smartasset

Tennessee Income Tax Calculator Smartasset

Historical Tennessee Tax Policy Information Ballotpedia

Historical Tennessee Tax Policy Information Ballotpedia

7 States Without Income Tax Mintlife Blog

7 States Without Income Tax Mintlife Blog

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

Why Are Tennesseans So Afraid Of An Income Tax Memphis Daily News

Comments

Post a Comment