What Percentage Is Taken Out Of Paycheck

What percentage of taxes are taken out of payroll. May 14 2019 admen Places At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is assessed at 145 percent.

Here S How Much Money You Take Home From A 75 000 Salary

Amount taken out of an average biweekly paycheck.

What percentage is taken out of paycheck. Everything from 9526 up to 38700 will be taxed at 12. Generally the more you earn the more taxes are taken out of your paycheck as a percentage of your salary. For a 500 paycheck 3825 is taken out by the employer to pay Social Security and Medicare taxes.

He will take the taxable amount of your pay multiply it by a certain percentage and add a base amount. Hi at one of my jobs i dont make very much so i am claiming 0 but i was wondering if anyone can tell me a typical percentage taken out of their paycheck when they claim 0. Standard paycheck taxes include federal income tax Social Security tax Medicare tax and.

But if youre a high earner you might not pay Social Security. An employee who claims exempt on income tax withholding has 765 percent of his income withheld for tax purposes but none of the federal income taxes a person normally pays explains the IRS. Combined the FICA tax rate is 153 of the employees wages.

Percentage amounts vary by tax and the rules of the administering agency. By Staff Writer Last Updated Apr 1 2020 74017 PM ET The 2017 Social Security withholdings total 124 percent and Medicare withholding rates total 29 percent according to the IRS. There is no single percentage of taxes taken out of your paycheck.

Current FICA tax rates. If your income falls into the 10 tax bracket youll be taxed at 10. Withholding from your paycheck is done on what is known as the graduated system.

If your income falls into a higher tax percent then youll have to pay the higher percent. How much tax should come out of your paycheck. Why is there no federal taxes taken out of my paycheck.

However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. Amount taken out of an average biweekly paycheck. Withholding rates are calculated on the basis that if your pay and circumstances remain consistent throughout the year you may be entitled to a small refund when you complete your tax return at the end of the financial year.

For employees there unfortunately isnt a one-size-fits-all answer to how much federal tax is taken out of my paycheck The amount withheld depends on several factors. How Much Money Is Typically Taken Out of a Paycheck. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

Your payer works out how much tax to withhold based on information you provide in your Tax file number declaration and Withholding declaration. Claiming 0 on my w-4 percentage of paycheck taken out. Total income taxes paid.

In other words if you take home 70 of your typical paycheck as a percentage of your. Plus federal and many state income tax rates vary depending on how much you earn your filing status and the number of withholding allowances you claim. What is the percentage that is taken out of a paycheck.

In most cases payroll taxes are withheld at percentages of employees taxable wages or salary. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. If you increase your contributions your paychecks will get smaller.

What Is the Tax Percentage Taken Out of Payroll Checks. What Is The Percentage Of Taxes Taken Out Of My Paycheck. Bonus Tax Calculator Use the bonus tax aggregate calculator to calculate withholding using your last paycheck amount on special wage payments such as bonuses.

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. Understanding Federal Income Tax FIT. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

Generally 62 percent of your income is taken out for Social Security taxes and 145 percent is taken out for Medicare taxes. It depends on the tax bracket your income falls into. For instance the first 9525 you earn each year will be taxed at a 10 federal rate.

That is because there are several taxes each calculated differently. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. I cant remember because with my last couple of jobs i have been claiming 1.

Use the bonus tax percent calculator to calculate withholding using supplemental tax rates on special wage payments such as bonuses. You owe tax at a progressive rate depending on how much you earn. However working with calculators and understanding how payroll taxes work can help give an idea of what take-home pay will look like.

For example if your pay is more than 209 but not more than 721 your employer will multiply your pay by 15 percent and add 1680 to the result to determine your tax withholding.

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

How To Explain Paycheck Withholdings Deductions Contributions To Your Employees Score

How To Explain Paycheck Withholdings Deductions Contributions To Your Employees Score

How To Calculate Take Home Pay As A Percentage Of Gross Pay The Motley Fool

How To Calculate Take Home Pay As A Percentage Of Gross Pay The Motley Fool

Free Paycheck Calculator Hourly Salary Smartasset

Free Paycheck Calculator Hourly Salary Smartasset

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

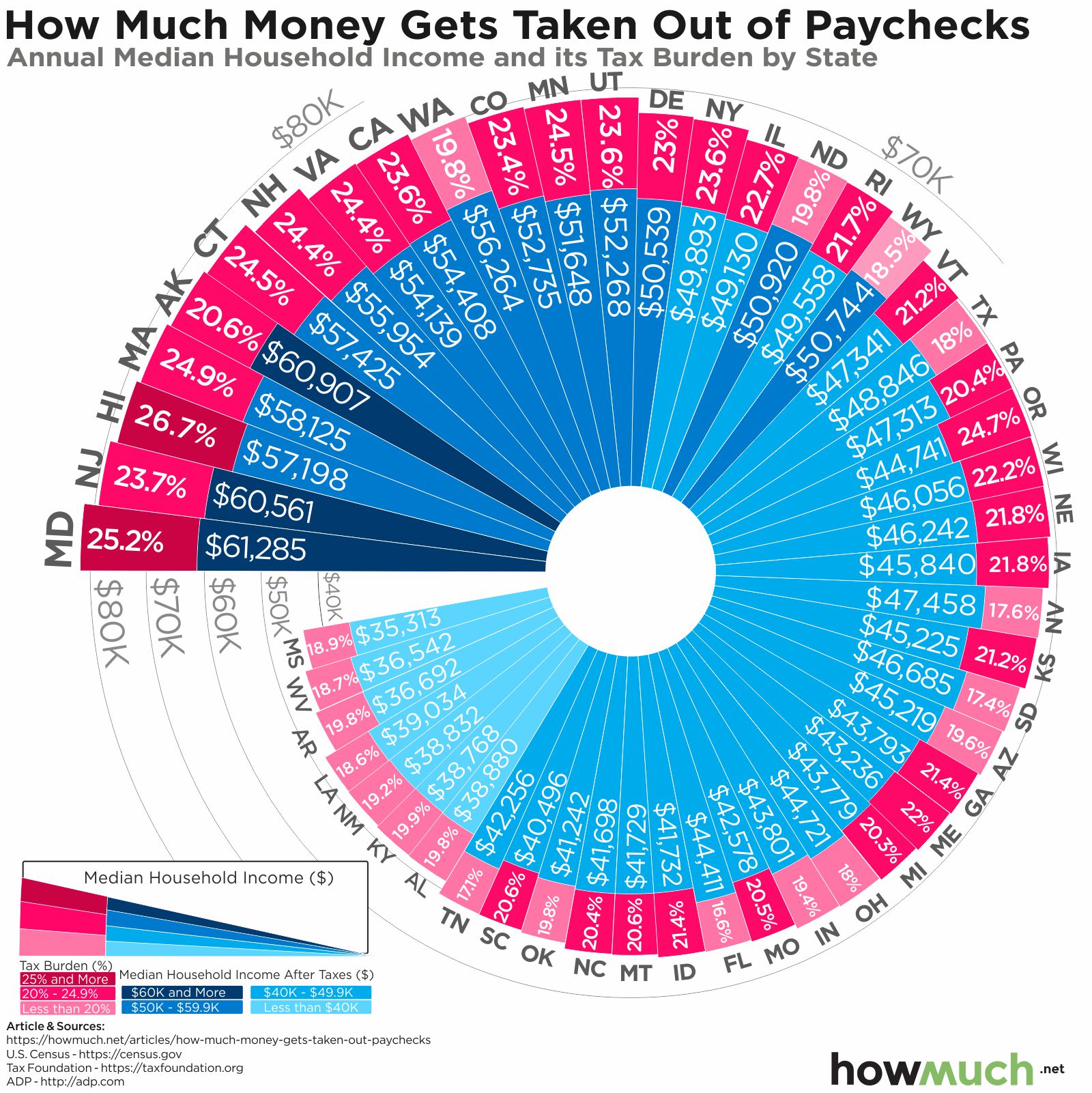

Visualizing Taxes Deducted From Your Paycheck In Every State

Visualizing Taxes Deducted From Your Paycheck In Every State

What Is The Percentage Taken Out For Taxes On A Paycheck

What Is The Percentage Taken Out For Taxes On A Paycheck

How To Calculate Payroll And Income Tax Deductions

How To Calculate Payroll And Income Tax Deductions

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Payroll Taxes Explained Cashay

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Comments

Post a Comment