Self Employed Unemployment Tax

For additional questions and the latest information on the tax deadline change visit. That rate is the sum of a 124 for Social Security and 29 for Medicare.

How Self Employed Can File For Unemployment Insurance Benefits Iowaworkforcedevelopment Gov Www

How Self Employed Can File For Unemployment Insurance Benefits Iowaworkforcedevelopment Gov Www

If you are self-employed visit the Self-Employed Individuals Tax Center page for information about your tax obligations.

Self employed unemployment tax. Understand the various types of taxes you need to deposit and report such as federal income tax social security and Medicare taxes and Federal Unemployment FUTA Tax. Self-employment tax applies to net earnings what many call profit. Self-employed individuals impacted by the pandemic like employees are eligible for income tax credits equivalent to the employment tax credits of employers.

Next steps Under normal circumstances you probably wouldnt qualify for regular unemployment insurance benefits if youre self-employed. Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from. To be eligible for the fourth grant you must be a self-employed individual or a member of a partnership.

Calculate Your Employment Taxes. Self-employment includes contracting working as a sole trader and small business owners. The government has issued unemployment insurance for self-employed individuals to help them manage their finances.

Keep in mind that under the CARES Act self-employed individuals are allowed to defer 50 of the social security tax on self-employment income between March 27. You cannot claim the grant if you trade through. One form of unemployment tax that self-employed workers do pay is the federal Social Security tax.

The self-employment tax rate is 153. In general anytime the wording self-employment tax is used it only refers to Social Security and Medicare taxes and not. The tax is 153 124 for Social Security and 29 for Medicare on their annual net income from the business.

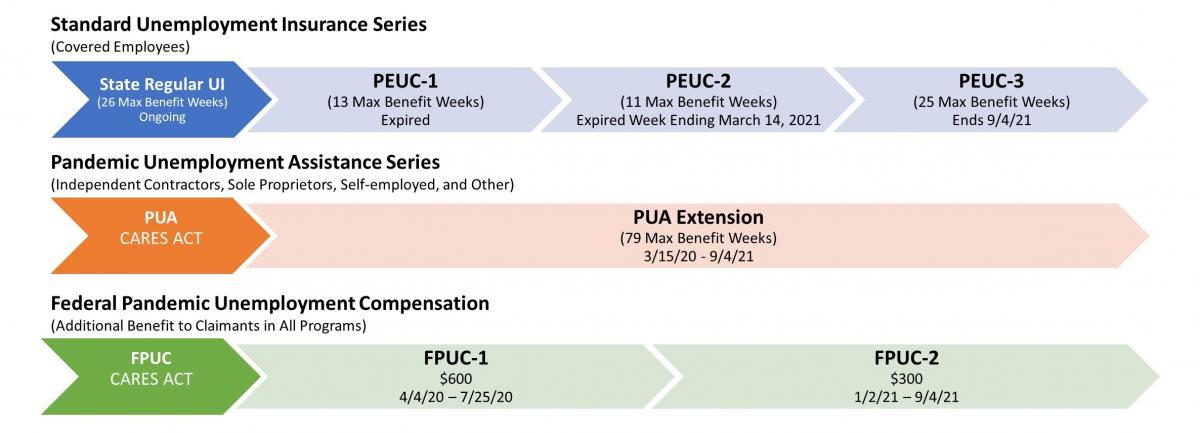

With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. This Pandemic Unemployment Assistance or PUA provides up to 39 weeks of benefits to qualifying individuals who are unable to work due to COVID-19.

Quarterly estimated tax payments are still due on April 15 2021. For 2020 this can be determined by dividing annual net earnings by 260. The credit is based on average daily self-employment income from net earnings for the period.

Usually a self-employed person can start in business without following any formal or legal set up tasks. Self-employment tax is also called SECA tax from the Self-Employed Contributions Act. Self-employment tax is 153 of net income so the determination of whether or not unemployment benefits are put on the Schedule C is a big deal.

Self-employed individuals pay self-employment tax each year if their net earnings from self-employment are 400 or more. Self-employment taxes are taxes paid by self-employed business owners t o the Social Security Administration for Social Security and Medicare based on earnings from a business you own not a corporation. A self-employed person thus owes regular income tax on their net income plus they owe self-employment tax on their net income.

Self-employed people pay a higher rate on Social Security taxes than traditional employees pay through paycheck deductions. The self-employment Social Security tax is a flat rate tax the federal government imposes on self-employed workers in addition to their regular income tax. Self-employment tax applies to net earnings and is made up of Social Security 124 and Medicare 29 taxes.

You pay tax on net profit by filing an individual income return. The federal tax filing deadline for individuals has been extended to May 17 2021. If youre self-employed you use your individual IRD number to pay tax.

Unemployment Insurance The federal response to the pandemic includes an expansion of unemployment benefits to self-employed people who typically are. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. Self-employed individuals generally must pay self-employment tax SE tax as well as income tax.

What You Need To Know About Collecting Unemployment If You Are Self Employed Wpxi

What You Need To Know About Collecting Unemployment If You Are Self Employed Wpxi

Unemployment Insurance Cares Act Patterson Harkavy Llp

Unemployment Insurance Cares Act Patterson Harkavy Llp

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

What Self Employed Workers Need To Know About The Coronavirus Stimulus Package The New York Times

What Self Employed Workers Need To Know About The Coronavirus Stimulus Package The New York Times

Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College

Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College

Unemployment Assistance For Self Employed Now Available Senator John R Gordner

Unemployment Assistance For Self Employed Now Available Senator John R Gordner

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Unemployment Insurance Department Of Labor

Unemployment Insurance Department Of Labor

Labor And Economic Opportunity Mixed Earners Unemployment Compensation Meuc

Labor And Economic Opportunity Mixed Earners Unemployment Compensation Meuc

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Mdol Pandemic Unemployment Assistance Pua Page

Mdol Pandemic Unemployment Assistance Pua Page

Comments

Post a Comment