How Do Tax Preparers Get Paid

A preparer tax identification number is an Internal Revenue Service identifier implemented in 1999 that has required all paid federal tax return preparers to register with the federal government. It only takes about 15 minutes to apply for or renew your PTIN online.

Foolproofme Tax Preparers Make Your Money Disappear

Foolproofme Tax Preparers Make Your Money Disappear

A tax preparer usually earn wages based on his level of tenure.

How do tax preparers get paid. How do I become a certified IRS tax preparer. They must sign in the paid preparers area of the return and give the taxpayer a copy of the return. Tax Preparers will most likely earn a compensation of Thirty Seven Thousand One Hundred dollars every year.

They receive compensation of up to 37100. How Does tax preparer get paid. Others may charge an hourly rate based on the complexity of the taxes the work they do and whether the taxes are personal or corporate.

Tax preparers are paid in a couple of different ways depending on the client type of taxes and the tax preparer. The basic IRS requirement for all paid tax preparers is to pass the suitability check and get issued a PTIN. New York requires that paid tax return preparers register with the state and pay a 100 fee if they are preparing over 10 commercial tax returns in a single calendar year.

FS-2018-5 March 2018 More than 83 million taxpayers paid someone to prepare their federal tax return in 2017. Obtain a Preparer Tax Identification Number PTIN from the IRS and. Generally anyone who gets paid to prepare or help prepare a federal tax return must have a Preparer Tax Identification Number PTIN.

Prefer to apply or renew by paper. Most do perform some kind of work outside of tax season and many diversify their income by offering other services in addition to tax preparation. 51 rows In Colorado for instance tax preparers earn an average of 73740 a year.

Importantly all of these jobs are paid between 85246 1972 and 163851 3791 more than the average Seasonal Tax Preparer salary of 43225. Some tax preparers charge a flat fee with additional flat charges for each additional form over the standard return. Fee collect allows you to deduct your tax preparation fees directly from.

The fee is 3595 and is non-refundable. Often tax preparers earn compensation amount every year. Purchase a 5000 tax preparer bond from an insurancesurety agent.

To do so you must. Visit PayScale to research tax preparer hourly pay by city experience skill employer and more. Answered April 4 2017 - Office ManagerTax Preparer Former Employee - Lexington TN.

If you are like most people you already have a computer multi-function printer an internet connection and a phone. 500 - 1000 total should be sufficient to cover all of your start-up expenses the first yearSome of the expenses such as part of the cost on the tax preparation software can be deferred and paid for with. The average hourly pay for a Tax Preparer is 1367.

How do tax preparers collect fee. Tax Preparers can make the most money in Massachusetts which has average pay levels of approximating 60440. 500 - 1000 total should be sufficient to cover all of your start-up expenses the first yearSome of the expenses such as part of the cost on the tax preparation software can be deferred and paid for with.

If you are like most people you already have a computer multi-function printer an internet connection and a phone. Depends on tax volumes and services and prices of returns filed. If so your initial out-of-pocket expenses should run 300 - 500.

They usually get an hourly rate plus commission or bonus based on the total amount done over a set amount. Take a 60-hour qualifying education course from a CTEC approved provider within the past 18 months. By the form or by the hour.

This is because we employ multiple tax preparers who have different levels of knowledge and productivity. This wages can be around 24000 to 36000. If so your initial out-of-pocket expenses should run 300 - 500.

Our sister company Peoples Tax charges by the form because it results in more equitable consistent and fair pricing. Sometimes is 2 to 3 percent of what income is generated. The answers will vary with each individual tax preparer but rest assured tax preparers can and do make a living year round.

But if you prefer to use the paper option Form W-12 IRS Paid Preparer Tax. If youre qualified getting hired for one of these related Seasonal Tax Preparer jobs may help you make more money than that of the average Seasonal Tax Preparer position. Professionals that work in these jobs are compensated highest in Finance and Insurance where they can get salary pay of 48940.

However once you start talking about the work of an enrolled agent there will be additional requirements such as a state license or an electronic filing identification numbers EFIN. There are two different ways you can charge customers for tax preparation services. Pay a 33 registration fee.

View this checklist to get started. Start your research by searching your states name and requirements for tax preparers to find checklists of what you need to accomplish before getting started.

How Tax Preparers Can Make Money Year Round Taxslayer Pro S Blog For Professional Tax Preparers

How Tax Preparers Can Make Money Year Round Taxslayer Pro S Blog For Professional Tax Preparers

How To Become A Tax Preparer And Make Money From Home Ivetriedthat

How To Become A Tax Preparer And Make Money From Home Ivetriedthat

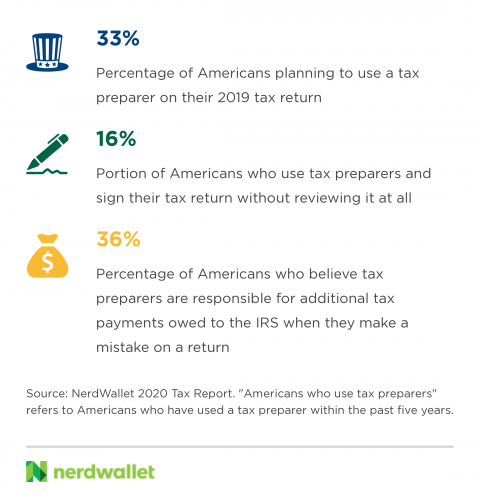

What To Know When You Hire A Tax Pro Nerdwallet

What To Know When You Hire A Tax Pro Nerdwallet

Become A Tax Preparer Before Next Season

7 States That Regulate Paid Tax Preparers Don T Mess With Taxes

Why Should You Hire A Tax Preparer

Why Should You Hire A Tax Preparer

Why Do Low Income Families Use Tax Preparers Tax Policy Center

Why Do Low Income Families Use Tax Preparers Tax Policy Center

How To Choose A Tax Preparer Score

How To Choose A Tax Preparer Score

How To Beat Online Services As A Tax Preparer

How To Beat Online Services As A Tax Preparer

How To Find The Perfect Tax Preparer This Tax Season

How To Find The Perfect Tax Preparer This Tax Season

7 Tips To Find The Best Tax Preparer Near You Nerdwallet

7 Tips To Find The Best Tax Preparer Near You Nerdwallet

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

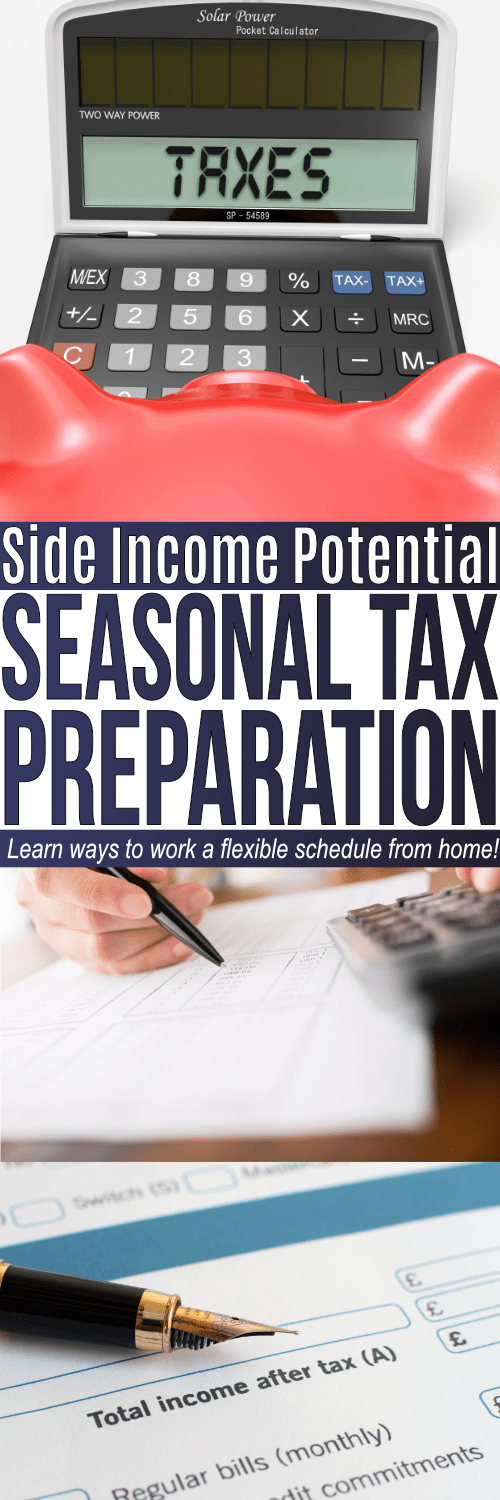

How To Become A Seasonal Tax Preparer To Earn Additional Income

How To Become A Seasonal Tax Preparer To Earn Additional Income

Here S How Much Money Accountants And Tax Preparers Earn In Every State

Here S How Much Money Accountants And Tax Preparers Earn In Every State

Comments

Post a Comment