What Is The Fica Tax Rate

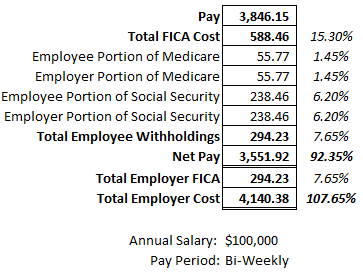

FICA tax refers to a payroll tax that takes 765 of an employees paycheck in order to fund Social Security 62 and Medicare 145. However these FICA tax rates are the sum of the Social Security tax and the Medicare tax.

How To Calculate Fica For 2020 Workest

How To Calculate Fica For 2020 Workest

According to the IRS the employers share of the Social Security tax and Medicare is the same as the employee.

What is the fica tax rate. Taxes under the Federal Insurance Contributions Act FICA are composed of the old-age survivors and disability insurance taxes also known as social security taxes and the hospital insurance tax also known as Medicare taxes. The self-employed persons FICA tax rate for 2020 January 1 through December 31 2020 is 153 on the first 137700 of net income plus 29 on the net income in excess of 137700. FICA Tax Rate.

Different rates apply for these taxes. If its above the wage base then you need to apply the Social Security tax rate to wages up to the wage base and the Medicare tax rate to all compensation explained next. Currently the FICA tax rate is 153 of the employees gross pay.

As of 2020 the FICA tax rates are set at 765 percent for both employees and employers. However employees are entirely responsible for owing this 09 tax implying that 145 FICA Tax Rate on your total wages is your employers responsibility while you would be in obligation to pay 145 FICA tax rate on wages up to 200000 range and an additional 09 working out to 235 on any income above this limit. As an employer you are required to withhold 62 of each employees taxable gross wages to cover this tax up to a maximum wage base limit.

FICA Tax Withholding Rates There are actually two different rate components broken out as follows. 124 for Social Security tax and 29 for Medicare tax. Social Security and Medicare Withholding Rates.

All told with the Federal Insurance Contributions Act 124 of your paycheck is paid to the government for Social Security taxes and another 29 for Medicare for a total FICA tax rate of 153. However calculating FICA is a little more complicated than simply multiplying the employees gross income by the FICA tax rate. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

If its below the wage base for a particular employee then the FICA tax rate applied is 765 percent. All told with the Federal Insurance Contributions Act 124 of your paycheck is paid to the government for Social Security taxes and another 29 for Medicare for a total FICA. How much is FICA tax.

FICA tax is a combination of social security tax and Medicare tax. For the 2021 tax year the wage base limit is 142800. All in all the IRS receives 153 on each employees wages for FICA tax.

Again this rate is applied to each employees taxable wages. The first part of FICA is the Social Security Tax. Social Security tax and Medicare tax.

The employer pays a tax equal to the amounts withheld from employee earnings 2 While there is no maximum to the Medicare contribution there is an additional 09 tax on wages over 200000 for. This means together the employee and employer pay 153. The Social Security tax rate is 62 of wages for 2020 and the Medicare tax rate is 145.

If that seems steep its because you arent paying the entirety of that. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively. Of that 153 the employer and employee each pay 765.

The current rate for Medicare is 145 for the employer and 145. The employer and the employee each pay 765. So each party pays 765 of their income for a total FICA contribution of 153.

This tax is also subject to what is known as the wage limit. In other words the self-employed persons FICA tax rate for 2020 includes all of the following. For the past couple of decades however FICA tax rates have remained consistent.

Now that you know the percentages you can calculate your FICA by multiplying your pay by 765. The taxes imposed on social security tax will be 62 and 145 for Medicare tax for each employee with matching contributions from their employer. The Social Security tax rate is set at 62 percent of gross pay.

The FICA rate for 2018 is 153. This is divided into four portions the employee contribution to Social Security the employer contribution to Social Security employer portion of Medicare and the employee portion of Medicare. The Social Security OASDI withholding rate is gross pay times 62 up to the maximum pay level for that year.

Employers and employees each pay the FICA tax rate of 765 which goes toward Social Security and Medicare taxes. Employers and employees split the tax. You withhold 765 of each employees wages each pay period.

The FICA withholding for the Medicare deduction is 145 while the Social Security withholding is 62. FICA taxes are divided into two parts.

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About Fica Social Security And Medicare Taxes

Learn About Fica Social Security And Medicare Taxes

A Small Business Guide To Medicare Taxes In 2021 The Blueprint

A Small Business Guide To Medicare Taxes In 2021 The Blueprint

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Is Fica Tax Contribution Rates Examples

What Is Fica Tax Contribution Rates Examples

Social Security Wage Base Increases To 142 800 For 2021

Social Security Wage Base Increases To 142 800 For 2021

Fica Tax Rate Page 1 Line 17qq Com

Fica Tax Rate Page 1 Line 17qq Com

Medicare Tax Purpose Rate Additional Medicare And More

Medicare Tax Purpose Rate Additional Medicare And More

The Fica Is Falling The Fica Is Falling

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About Fica Social Security And Medicare Taxes

Learn About Fica Social Security And Medicare Taxes

What Is The Fica Tax 2021 Tax Rates And Instructions Onpay

Distributional Effects Of Raising The Social Security Payroll Tax

Distributional Effects Of Raising The Social Security Payroll Tax

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

The Fica Tax Your Ticket To Social Security Benefits Social Security Intelligence

The Fica Tax Your Ticket To Social Security Benefits Social Security Intelligence

Comments

Post a Comment